The information and data provided below from the American Association for Long-Term Care Insurance is based on data researched or gathered by the organization. Information may be used with proper citation (Data from the American Association for Long-Term Care Insurance, www.aaltci.org) unless as indicated otherwise. THANK YOU..

PERCENTAGE DIFFERENCE BETWEEN LOWEST & HIGHEST PRICES - with the 3% Option

Male (71%) ------- Female (60%) ------- Couple (52%)

Rates above are for an initial pool of benefits equal to $165,000 (each at age 55). Value of benefits when policyholder reaches age 85 equals $222,400 each (@1%), $298,900 (@2%) or $400,500 each (@ 3%). Prices for State of IL. Prices can vary by State. Calculated: January 2021

| Annual Premium - Purchase Age 60 | ||

|---|---|---|

| Single Male, Age 60 (Select Health) $165,000 level benefits | $ 1,175 | |

| Single Male, Age 60 (Select Health) benefits grow at 1% yearly | $ 1,600 | |

| Single Male, Age 60 (Select Health) benefits grow at 2% yearly | $ 2,000 | |

| Single Male, Age 60 (Select Health) benefits grow at 3% yearly | $ 3,525 | |

| Single Male, Age 60 (Select Health) benefits grow at 5% yearly | $ 3,800 | |

| Single Female, Age 60 (Select Health) $165,000 level benefits | $ 1,900 | |

| Single Female, Age 60 (Select Health) benefits grow at 1% yearly | $ 2,550 | |

| Single Female, Age 60 (Select Health) benefits grow at 2% yearly | $ 3,300 | |

| Single Female, Age 60 (Select Health) benefits grow at 3% yearly | $ 4,300 | |

| Single Female, Age 60 (Select Health) benefits grow at 5% yearly | $ 6,600 | |

| Couple Both Age 60 (Select Health) $165,000 level benefits | $ 2,600 combined | |

| Couple Both Age 60 (Select Health) benefits grow at 1% yearly | $ 3,525 combined | |

| Couple Both Age 60 (Select Health) benefits grow at 2% yearly | $ 4,525 combined | |

| Couple Both Age 60 (Select Health) benefits grow at 3% yearly | $ 5,800 combined | |

| Couple Both Age 60 (Select Health) benefits grow at 5% yearly | $ 8,750 combined | |

| Annual Premium - Purchase Age 65 | ||

|---|---|---|

| Single Male, Age 65 (Select Health) $165,000 level benefits | $ 1,700 | |

| Single Male, Age 65 (Select Health) benefits grow at 1% yearly | $ 2,165 | |

| Single Male, Age 65 (Select Health) benefits grow at 2% yearly | $ 2,600 | |

| Single Male, Age 65 (Select Health) benefits grow at 3% yearly | $ 3,135 | |

| Single Male, Age 65 (Select Health) benefits grow at 5% yearly | $ 4,200 | |

| Single Female, Age 65 (Select Health) $165,000 level benefits | $ 2,700 | |

| Single Female, Age 65 (Select Health) benefits grow at 1% yearly | $ 3,400 | |

| Single Female, Age 65 (Select Health) benefits grow at 2% yearly | $ 4,230 | |

| Single Female, Age 65 (Select Health) benefits grow at 3% yearly | $ 5,265 | |

| Single Female, Age 65 (Select Health) benefits grow at 5% yearly | $ 7,225 | |

| Couple Both Age 65 (Select Health) $165,000 level benefits | $ 3,750 combined | |

| Couple Both Age 65 (Select Health) benefits grow at 1% yearly | $ 4,735 combined | |

| Couple Both Age 65 (Select Health) benefits grow at 2% yearly | $ 5,815 combined | |

| Couple Both Age 65 (Select Health) benefits grow at 3% yearly | $ 7,150 combined | |

| Couple Both Age 65 (Select Health) benefits grow at 5% yearly | $ 9,675 combined | |

PERCENTAGE DIFFERENCE BETWEEN LOWEST & HIGHEST PRICES - with the 3% Option

Male (77%) ------- Female (84%) ------- Couple (46%)

Rates above are for an initial pool of benefits equal to $165,000 (for EACH)(each at age 65). Value of benefits when EACH policyholder reaches age 85 equals $201,300 each (@1%), $245,200 (@2%) or $296,000 each (@ 3%). Prices for State of IL. Prices can vary by State. Calculated: January 2021 (Age 60 added July 2021)

| Linked-Benefit (Life Insurance + LTC) Policy - Company A - YEARLY PREMIUM PAYMENTS | ||

|---|---|---|

| Single Male, Age 55 - Pool of LTC Benefits = $180,000 / Min. death benefit = $120,000 | $ 4,625 | |

| Single Female, Age 55 - Pool of LTC Benefits = $180,000 / Min. death benefit = $120,000 | $ 4,600 | |

| Linked-Benefit (Life Insurance + LTC) Policy - Company B - ONE SINGLE PREMIUM PAYMENTS | ||

|---|---|---|

| Single Male, Age 55 - Pool of LTC Benefits = $180,000 / Min. death benefit = $130,000 | $ 75,900 | |

| Single Female, Age 55 - Pool of LTC Benefits = $180,000 / Min. death benefit = $130,000 | $ 77,000 | |

| Linked-Benefit (Life Insurance + LTC) Policy - Company C - YEARLY PREMIUM PAYMENTS | ||

|---|---|---|

| Single Male, Age 55 - Pool of LTC Benefits = $167,000 / Min. death benefit = $167,000 | $ 5,010 | |

| Single Female, Age 55 - Pool of LTC Benefits = $167,000 / Min. death benefit = $167,000 | $ 4,550 | |

Rates above include NO INFLATION GROWTH OPTION so benefit pool WILL NOT INCREASE. Prices for State of AZ. Prices can vary by State. Calculated: January 2021

| Linked-Benefit (Life Insurance + LTC) Policy - Company A - YEARLY PREMIUM PAYMENTS | ||

|---|---|---|

| Single Male, 55 - LTC Benefits @ Age 90 = $521,850 / $226,000 growing death benefit | $ 6,300 | |

| Single Female, 55 - LTC Benefits @ Age 90 = $521,850 / $242,500 growing death benefit | $ 6,750 | |

| Linked-Benefit (Life Insurance + LTC) Policy - Company C - YEARLY PREMIUM PAYMENTS | ||

|---|---|---|

| Single Male, 55 - LTC Benefits @ Age 90 = $455,300 / Min. death benefit = $167,0000 | $ 6,710 | |

| Single Female, 55 - LTC Benefits @ Age 90 = $455,300 / Min. death benefit = $167,000 | $ 7,210 | |

Policies include a 3% annual inflation growth option so benefits increase each year the policy is in place.. Prices for State of AZ. Prices can vary by State. Calculated: January 2021

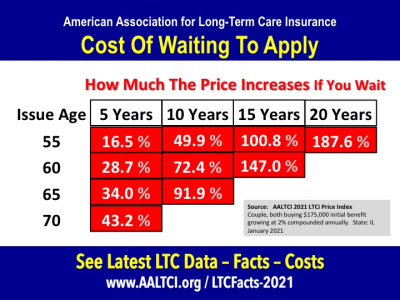

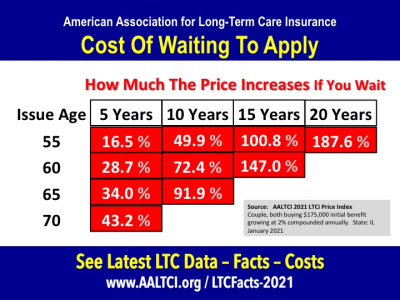

Data from AALTCI (2021) - A comparison of equal coverage. If you wait (say from age 55 to 65) same initial coverage costs 49.9% more. NOT ONLY WILL YOU PAY MORE but you forfeit the increase in potential available benefits (thanks to having an annual growth factor. Plus YOU RISK BEING DECLINED for health reasons or paying more. Finally, YOU MAY LOSE THE COUPLE'S DISCOUNT due to spouse's death, divorce or denial of coverage.

When citing data, please credit: "American Association for Long-Term Care Insurance, 2021, www.aaltci.org"

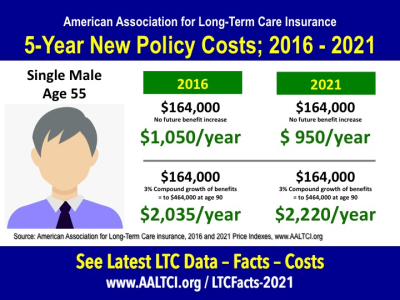

A comparison of equal coverage. Top row with no growth of benefits. Bottom row with 3% compound inflation option.

When citing data, please credit: "American Association for Long-Term Care Insurance, 2021, www.aaltci.org"

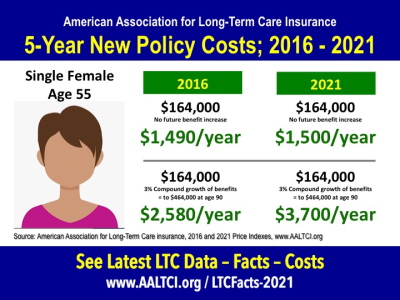

A comparison of equal coverage. Top row with no growth of benefits. Bottom row with 3% compound inflation option.

When citing data, please credit: "American Association for Long-Term Care Insurance, 2021, www.aaltci.org"

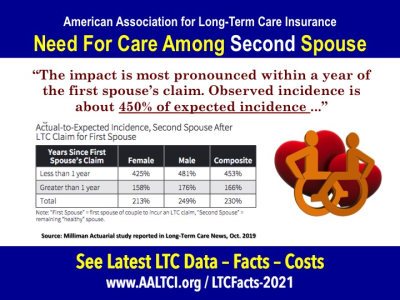

A study by Milliman Actuarial ("Is Your Spouse Contagious?") examined LTC insurance claims of married couples. The need for care for the second spouse after the first spouse commences a claim is consistently higher that they would have expected using their prior data.

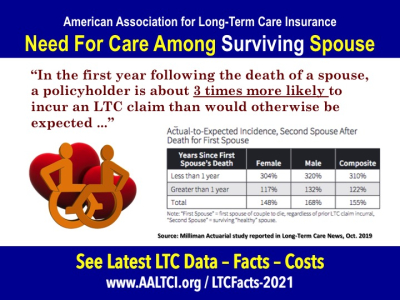

More from the study by Milliman Actuarial ("Is Your Spouse Contagious?"). In the first year following the death of a spouse, a policyholder is about three times more likely to incur an LTC claim than otherwise would have been expected in the absence of spousal mortality information.

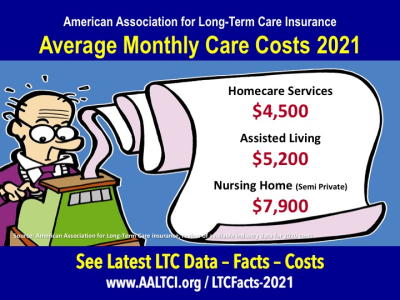

Costs of care vary and we strongly recommend consumers speak with a local professional who can best share costs for your particular area.

WHY do we post MONTHLY costs? Because most LTC policies (especially linked benefit) cite a maximum monthly benefit payout on their illustrations.

WHY do we post AVERAGES when rates can vary significantly? Because media like reporting 'averages' and this addresses their needs.

When citing data, please credit: "American Association for Long-Term Care Insurance, 2021, www.aaltci.org"

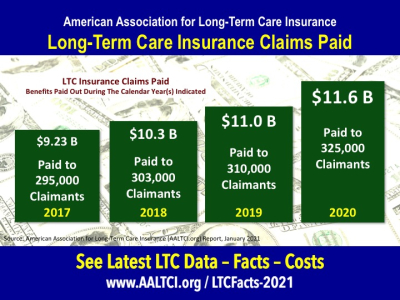

Insurers pay benefits to insured clients. Traditional LTC insurance data.

When citing data, please credit: "American Association for Long-Term Care Insurance, 2021, www.aaltci.org"

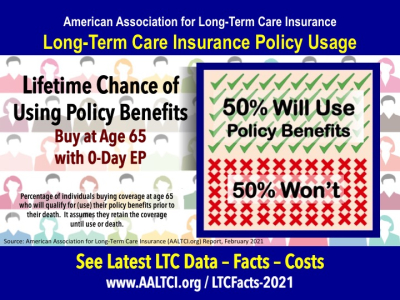

Lifetime chance that someone who buys a traditional long-term care insurance policy at age 65 will use their policy before they die. Assumes they pay premiums until accessing benefits or die.

When citing data, please credit: "American Association for Long-Term Care Insurance, 2021, www.aaltci.org"

The average time from when individual purchased their long-term care insurance policy until when they became eligible for benefits.

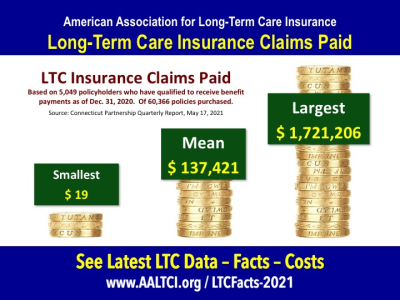

A look at just over 5,000 individual policyholders who have received benefits from their long-term care insurance policy. The largest long-term care insurance policy claim benefit paid has exceeded $1.7 million.

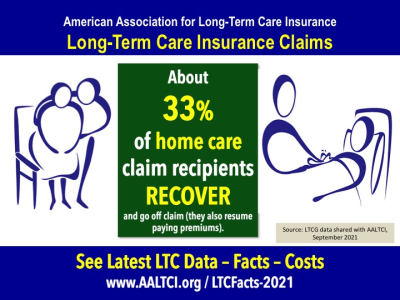

Data shared by LTCG and covers home care claims (pre-pandemic data). Note that when a policyholder recovers and goes 'off claim' they also resume paying insurance premiums.

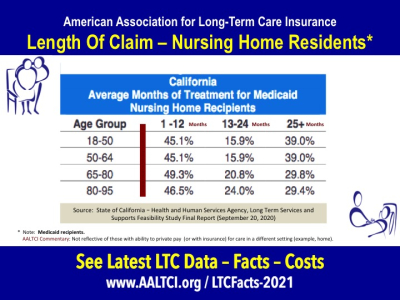

Most nursing home claims (and these are for Medicaid recipients) last one or two years. Why do we emphasize Medicaid recipients? Because Medicaid often favors institutional care versus care at home.

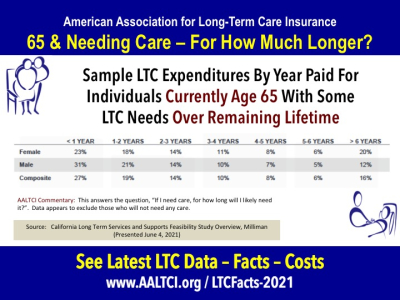

Interesting data that looks at what can be expected when someone 65 has some need for care. Remember that NOT all individuals will need long-term care.

Each year, over 95 percent of individuals with traditional policies keep them in force. Five (5) percent drop coverage every year BUT this includes those who DIE. Even when facing rate increases, policyholders do NOT drop their coverage. Most accept other options offered by the insurance company. (January 2021)

When citing data, please credit: "American Association for Long-Term Care Insurance, 2021, www.aaltci.org"

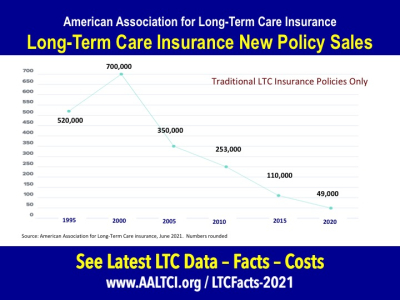

Some 49,000 individuals purchased new (traditional or health-based) long-term care insurance in 2020. While a significant decline from prior years, note the growth of linked-benefit products purchased (see chart below).

insurance sales 2020" width="" height="" />

insurance sales 2020" width="" height="" />

When citing data, please credit: "American Association for Long-Term Care Insurance, June 2021, www.aaltci.org"

Sales of new (traditional or health-based) long-term care insurance have ranged from a high of over 700,000 to the current level .

When citing data, please credit: "American Association for Long-Term Care Insurance, June 2021, www.aaltci.org"

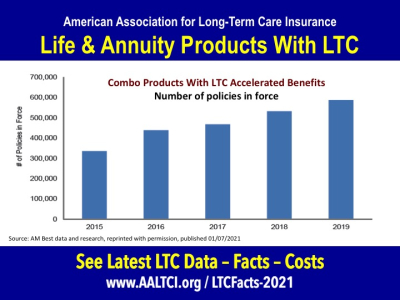

Reprinted with permission from AM Best

If you would like additional information please call or email Jesse Slome, Executive Director of the American Association for Long-Term Care Insurance.